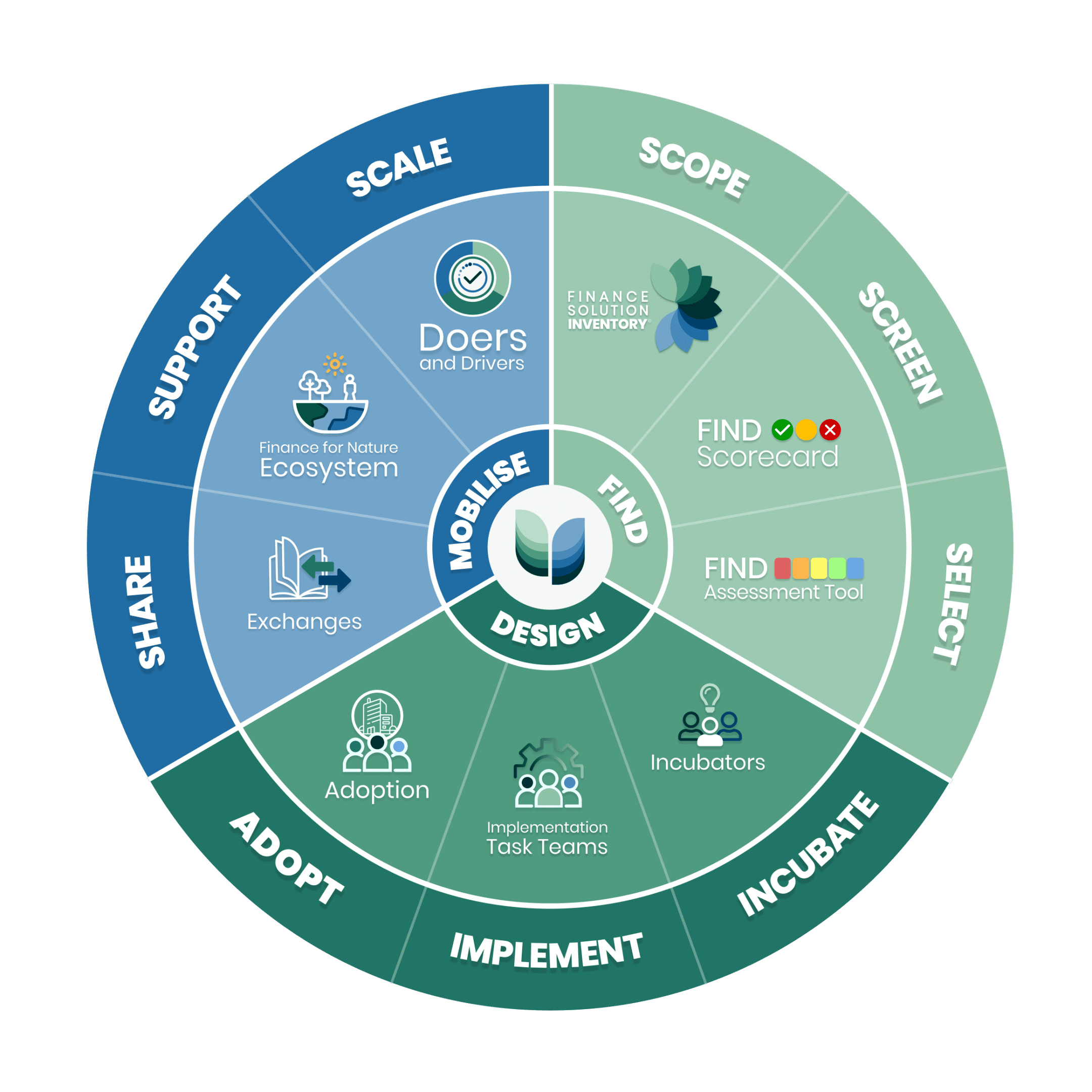

The Finance Model operates through a tried and tested 3-part process that can be used anywhere by anyone seeking to finance nature.

Each part of the Finance Model has 3 components and a set of user-friendly tools.

By using a targeted approach, objective criteria and inclusive engagement the FIND Part of the Finance Model identifies the right finance solutions, for the right places, with the right people.

It provides Nature Finance Doers and Drivers with the ability to maximise results by starting the sustainable finance journey on the right track. To undertake FIND, the Coalition facilitates a dedicated FIND Workshop.

SCOPE all possible finance solutions to identify the most viable.

By using the Finance Solution Inventory, augmented by desktop research and local knowledge, we collaboratively cast the net wide ensuring all possible finance solutions and ideas are considered.

SCREEN all finance solution options to arrive at a short list.

By using the FIND Scorecard rapid screening allows for fast yet accurate prioritisation of finance solutions creating a shortlist for selection.

The Scorecard focuses on enabling conditions and Building Blocks per finance solution and their application to individual landscapes and seascapes.

SELECT 2-3 finance solutions with the highest probability for success for DESIGN.

The FIND Assessment Tool, a mechanism utilising carefully designed criteria and weighted scoring, delivers the ultimate selection of solutions.

This is facilitated by independent experts with guidance from the Coalition to objectively interrogate an individual finance solution for selection.

With rigorous coordination and dedicated support from the Coalition Core Team, the DESIGN Part of the Finance Model strategically transforms finance solution ideas into implementation within clear impact parameters ensuring timeous results and returns.

It provides Nature Finance Doers and Drivers with the tools, templates and timeframes to effectively build a finance solution with navigational input from the Coalition and achieve success by seeing finance begin to flow.

INCUBATE finance solution ideas to determine if they are viable.

Incubators are structured 6-month platforms that harness the power of cross-cutting experts who work together to determine the Building Blocks and viability of new and innovative finance solution ideas.

If we are going to put money, time and effort into a new finance solution we want to know if it has what it takes!

IMPLEMENT viable finance solutions through rigorous and coordinated activities to activate them.

We use Finance Solution Roadmaps which include high-level Implementation Pathways per finance solution and detailed Implementation Plans per naturescape, providing the practical action steps to implement finance solutions.

Solution Roadmaps aim to support unlocking impact within a 1–3 year period.

The sustainable finance journey is fraught with many uncertainties and we want to ensure we have charted the best route to a successful destination!

Drives finance solutions over the line to be Adopted into a long-term home.

Adoption provides a framework to identify, facilitate and contract with a long-term home where a finance solution can be housed.

In order to be sustainable, finance solutions need the infrastructure of a long-term home; this is the foundation for impact at scale!

The MOBILISE Part of the Finance Model harnesses the power of collective action to mobilise social and financial capital to take finance solutions to scale.

The Coalition fosters a Finance for Nature Ecosystem that drives financing nature through cross-sectoral and multidisciplinary collaboration and this network of social capital is made available to our Nature Finance Doers and Drivers.

SHARE by exchanging knowledge and building capacity for nature finance.

We undertake a range of exchanges.

Exchanges are crafted events and communications that transfer knowledge and build capacity to boost innovation and scale up nature finance across countries and sectors.

SUPPORT by catalysing key partnerships and access to capital.

The Finance for Nature Ecosystem represents a deep knowledge base and support structure across 19 different sectors, numerous governments, large and local NGOs and community led organisations, to foster an all hands-on-deck approach to solving nature’s finance needs.

SCALE by walking a Sustainable Finance Journey with Nature Finance Doers and Drivers.

Nature Finance Doers and Drivers are NGOs or financial institutions that walk shoulder-to-shoulder with the Coalition to understand, adopt and utilise the Finance Model.

The Sustainable Finance Coalition is a registered NPC, NPO and PBO.

The Coalition is led by Founder and CEO, Candice Stevens, and supported by a Coalition Core Team. Our diverse and innovative Team hails from across Africa offering multi-disciplinary expertise and experience. The delivery of our Finance Model is enhanced through collaboration with our Finance for Nature Doers at Scale, Strategic Partners and Specialist Contributors. We are supported in our efforts by our Board and a voluntary advisory Council comprised of thought leaders from 19 sectors. The Coalition thanks and acknowledges the collective action required to design finance solutions for nature at scale from across the many parts of our Finance for Nature Ecosystem, and the role of our donors, funders and investors. NPC: 2023/202978/08 | NPO: 314-003 | PBO: 930083078